Financial report

Annual Publications

From retiring early to funding a college education to fueling your passion for philanthropy, we want to know what’s important to you, your spouse, and your family — and how you see your needs changing over time.

Before we meet, we ask you to spend a little time reflecting on what’s truly important. Then, we lead you through a proven process designed to unearth details, create dialog, and build a basis of shared understanding.

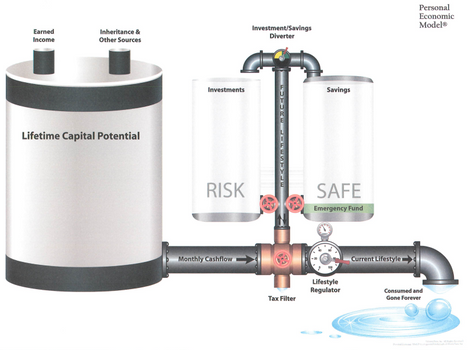

When you start organizing your portfolio you will want to consider how you will be spending your money after you retire. Some money will be deposited directly into your checking account; such as Social Security where as other income could be less ...

Business owners accept without question the wisdom of insuring the firm against the loss of its property values. We take care to insure the physical assets against fire, tornados and other disasters. Yet, protection from the loss a key executive m...